Cement Clinker Price: Market Trends and Key Factors

The global cement industry relies on a single foundational input: clinker. As the primary intermediate material in cement manufacturing, this product plays a decisive role in determining production costs, final cement quality, and overall competitiveness within construction markets. For this reason, movements in cement clinker price are closely watched across infrastructure, housing, and industrial development sectors worldwide.

A clear understanding of how clinker pricing is formed—along with the forces that influence its volatility—is essential for producers, traders, exporters, and bulk buyers. This article delivers a comprehensive analysis of cement clinker price, examining market behavior, structural cost drivers, and long-term industry trends.

Economic Role of Clinker in Cement Production

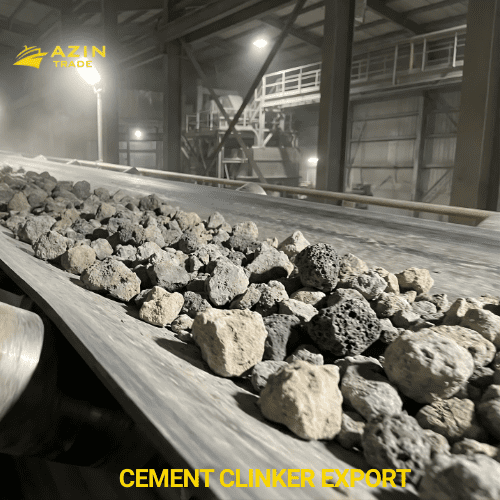

Clinker is a nodular material created through the high-temperature processing of limestone and corrective raw materials inside rotary kilns. After cooling, it is ground with gypsum to produce finished cement. The chemical composition and mineral structure of clinker largely determine cement strength development, durability, and performance consistency.

Because this material is highly energy-intensive to produce and has limited substitution potential, its pricing exerts a strong downstream effect on the entire construction value chain. Increases in cement clinker price typically translate into higher cement costs, influencing public infrastructure budgets, private construction projects, and long-term development planning.

Cement Clinker Price as a Strategic Market Signal

Unlike finished cement, clinker is actively traded across borders. Many regions rely on imported clinker to offset limited domestic capacity or to balance seasonal demand spikes. As a result, cement clinker price reflects a combination of manufacturing costs, international trade conditions, logistics efficiency, and regional supply-demand dynamics.

In many markets, clinker pricing trends act as an early signal of future shifts in cement availability and construction activity.

Global Market Trends Shaping Cement Clinker Price

Infrastructure Expansion and Urban Development

Sustained investment in transportation networks, housing, and large-scale infrastructure continues to drive global demand for clinker-based materials. Major projects such as highways, ports, bridges, and urban developments significantly increase consumption levels, placing upward pressure on Raw clinker price, particularly in supply-constrained regions.

Growth of Cross-Border Trade

Over the past decade, international trade in clinker has expanded steadily. Cost-efficient producers increasingly target export destinations, while importing countries depend on clinker shipments to stabilize domestic cement markets. This trade expansion has made cement clinker price more sensitive to freight rates, port capacity, and geopolitical conditions.

Volatility in Energy Markets

Energy remains one of the largest contributors to clinker production costs. Price fluctuations in coal, electricity, natural gas, and alternative fuels directly affect Raw clinker price, elevating the importance of energy efficiency and fuel diversification strategies.

Core Cost Drivers Behind Cement Clinker Price

Raw Materials and Quarry Operations

Clinker production depends heavily on the availability and quality of limestone. Expenses associated with quarrying, crushing, and internal transportation have a direct impact on overall pricing. Regions with easy access to high-quality raw materials typically maintain more competitive cost structures.

Kiln Technology and Operational Performance

Plants equipped with modern kiln systems and optimized heat recovery achieve lower fuel consumption and reduced operating expenses. In contrast, outdated production lines often face higher clinker prices due to inefficiencies, downtime, and increased maintenance requirements.

Environmental and Regulatory Compliance

Stricter environmental regulations are reshaping production economics worldwide. Investments in emission control systems, carbon reduction technologies, and alternative fuels add to operational costs and influence cement clinker price, particularly in tightly regulated markets.

Quality Differentiation and Pricing

Clinker quality varies significantly depending on mineral composition, phase balance, and consistency. Higher-grade material enables cement producers to achieve improved strength development, reduced variability, and better long-term performance.

For this reason, buyers frequently accept a higher Raw clinker price when it is supported by reliable chemical analysis, stable production quality, and predictable performance in cement grinding.

Logistics and Their Influence on Cement Clinker Price

Transportation represents a substantial portion of total clinker cost, especially in export-oriented supply chains. Distance to ports, vessel availability, bulk shipping rates, and delivery terms such as FOB, CFR, or CIF all play a decisive role in final pricing.

Producers with efficient logistics infrastructure and access to cost-effective shipping routes enjoy a clear competitive advantage in global clinker trade.

Regional Variations in Cement Clinker Price

Pricing levels differ widely between regions due to variations in:

-

Energy costs

-

Raw material accessibility

-

Environmental requirements

-

Local supply and demand balance

Countries combining low energy expenses with large-scale production capacity often emerge as key exporters, offering more competitive cement clinker prices in international markets.

How Buyers Should Assess Cement Clinker Price

Evaluating clinker pricing requires a broader perspective than simple cost comparison. Buyers should consider:

-

Chemical and physical test results

-

Compliance with international standards

-

Supply consistency and volume reliability

-

Long-term performance history of the supplier

In many cases, a marginally Raw clinker price results in lower overall production costs by reducing operational risks and quality variability.

Future Outlook for Cement Clinker Price

Looking ahead, clinker pricing will increasingly be shaped by sustainability policies, energy transition strategies, and technological innovation. Producers that invest in efficiency improvements, emissions reduction, and alternative fuels are better positioned to maintain stable pricing under evolving regulatory conditions.

At the same time, ongoing global construction demand ensures that clinker will remain a strategically important commodity within the cement industry.

Conclusion

Cement clinker price is determined by a complex interaction of production economics, energy markets, logistics performance, quality standards, and global demand patterns. A structured understanding of these factors enables more informed decision-making for manufacturers, traders, and buyers.

In a highly competitive cement market, informed insight into clinker pricing dynamics is not merely advantageous—it is a strategic requirement