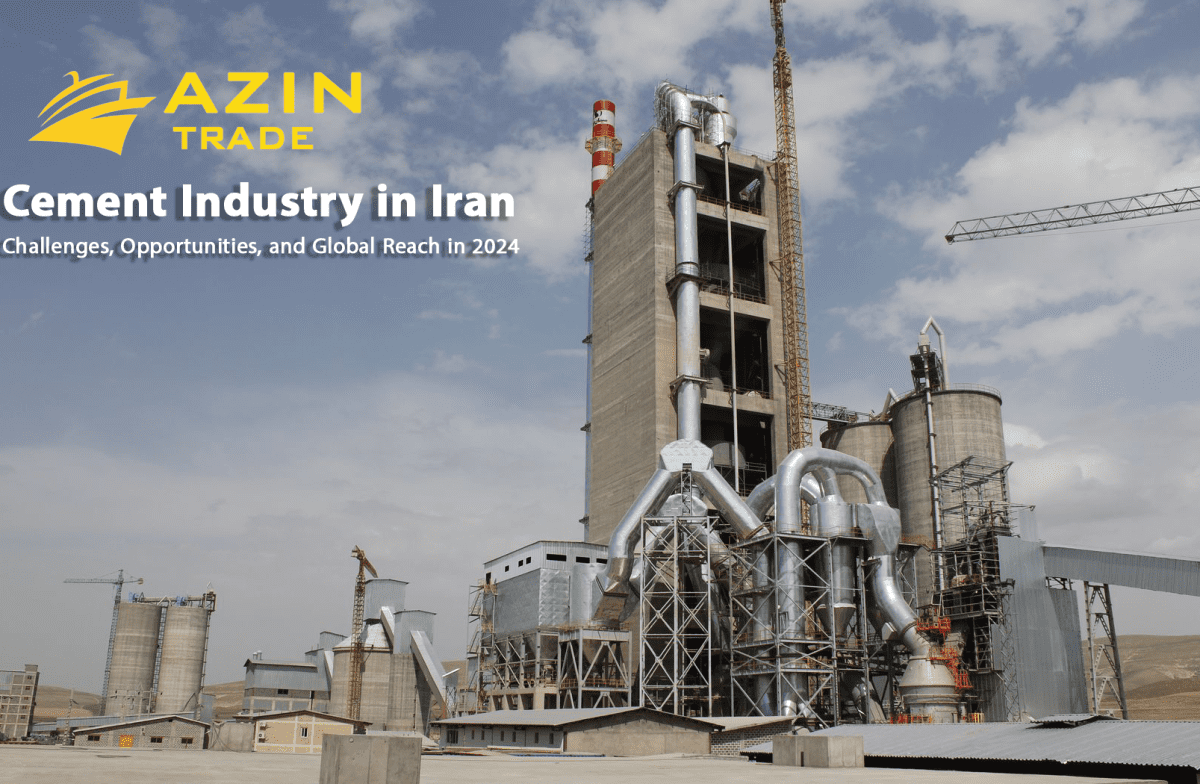

Cement Industry in Iran: Challenges, Opportunities, and Global Reach in 2024

As one of the largest producers of cement in the world, Iran's cement industry plays a crucial role in its economy and infrastructure development. Despite facing various challenges, such as economic sanctions and market fluctuations, the Iranian cement sector remains a key player in the global market. In 2024, the industry is navigating a mixed landscape of declining exports but growing opportunities, particularly in key markets such as Pakistan, Kazakhstan, and India. Companies like Azintrade are spearheading Iran’s cement export efforts, delivering a variety of high-quality products to countries around the globe.

Current State of Iran's Cement Exports

Iran’s cement industry has traditionally been a significant contributor to both the domestic economy and the global cement trade. Between March 2023 and February 2024, Iran shipped 619 consignments of cement, involving 163 Iranian exporters and 135 buyers. While these numbers represent a robust trading network, they also mark a 34% decline compared to the previous year. This reduction reflects the multiple economic and geopolitical challenges Iran has faced over the past year.

In February 2024 alone, Iran exported just 21 cement shipments, which highlights a 49% decrease from the same month in 2023 and a 54% drop from January 2024. These figures suggest a downward trend in cement exports, driven by factors such as inflation, currency devaluation, and shifting demand in international markets. Nevertheless, Iran remains a crucial supplier of cement, particularly to its neighboring countries and other key markets.

Key Export Markets: Pakistan, Kazakhstan, and India

Despite the overall decline in exports, Iran continues to be a dominant supplier in certain regions. Pakistan, Kazakhstan, and India stand out as the top destinations for Iranian cement. These countries have a growing demand for cement, driven by their expanding infrastructure projects and rapid urbanization.

- Pakistan: As a neighboring country, Pakistan has been a longstanding trade partner for Iran’s cement industry. With increasing infrastructure development and housing projects in Pakistan, Iranian cement continues to be a critical import to meet the growing construction needs. The geographical proximity between the two countries allows for more efficient logistics and reduced transportation costs, making Iran a preferred supplier.

- Kazakhstan: This Central Asian nation is experiencing significant growth, particularly in its energy and construction sectors. Kazakhstan’s infrastructure development projects, including highways, railways, and residential construction, have driven an increased demand for cement. Iran’s ability to provide high-quality cement products at competitive prices positions it as a key exporter to Kazakhstan.

- India: As one of the fastest-growing economies in the world, India’s demand for construction materials, including cement, is skyrocketing. The country’s large-scale infrastructure projects, coupled with rapid urbanization, make India a major destination for Iranian cement. Although India has its own cement production capacity, the sheer scale of its development initiatives requires supplementary imports, and Iran has been one of the key suppliers.

Factors Contributing to Declining Exports

Several factors have contributed to the recent decline in Iran's cement exports. Understanding these issues is key to analyzing the industry's trajectory and potential future growth.

- Economic Sanctions: Ongoing international sanctions have severely impacted Iran's economy, including its cement industry. Sanctions have limited the country’s ability to engage in international trade, reduce foreign investment, and complicate logistics for exports. These factors have made it more challenging for Iranian exporters to maintain their positions in certain global markets.

- Currency Fluctuations: The weakening of the Iranian rial has had a direct effect on the cost of production and export. While the devaluation of the rial makes Iranian products more affordable for foreign buyers, it also increases the cost of importing raw materials, transportation, and other operational expenses for domestic producers. This has created a delicate balance between competitive pricing and maintaining profitability.

- Global Economic Shifts: The global cement market has also seen fluctuations due to macroeconomic factors, such as the slowdown in China’s construction sector and the aftereffects of the COVID-19 pandemic. As key markets adjust to new economic realities, demand for cement imports has shifted, leading to fluctuations in the volume of shipments from countries like Iran.

- Infrastructure Competition: Other major cement-producing nations, such as Turkey, have ramped up their exports in recent years, increasing competition in regional markets. This has put additional pressure on Iranian cement exporters to find and secure new markets to compensate for any potential losses in traditional ones.

Azintrade: Leading the Way in Cement Exports

Amid these challenges, Iranian companies like Azintrade are playing a pivotal role in maintaining the country's prominence in the global cement industry. Azintrade is one of Iran's leading producers and exporters of cement, known for its commitment to quality and customer satisfaction. With a wide range of products, including various types of cement tailored for different construction needs, Azintrade has established a strong foothold in multiple international markets.

Azintrade exports cement to countries across Asia, the Middle East, Africa, and beyond. By adhering to international quality standards and leveraging its strategic geographic location, the company is well-positioned to serve a diverse clientele. Azintrade’s focus on efficiency, customer-centric service, and innovation allows it to stay competitive even in a fluctuating market. The company’s ability to navigate complex trade environments and deliver high-quality products ensures it remains a trusted partner for global buyers seeking reliable cement supplies.

Opportunities for Growth in 2024 and Beyond

While the overall trend in cement exports has seen some decline, there are still numerous opportunities for growth, both within Iran and in its key export markets.

- Infrastructure Projects: Iran’s domestic infrastructure development is expected to ramp up in 2024, driven by government investment in housing, transportation, and energy sectors. These projects will likely increase the demand for cement internally, providing a boost to local production and potentially offsetting some of the declines seen in exports.

- New Markets: As global demand for construction materials continues to grow, especially in developing regions, Iran has the opportunity to tap into new markets. Countries in Africa and Southeast Asia are experiencing rapid urbanization and infrastructure expansion, creating potential for Iranian cement producers like Azintrade to expand their global reach.

- Sustainability and Innovation: The cement industry is increasingly focusing on sustainability, and Iran’s producers have the chance to lead in this area by adopting green technologies and processes. By reducing carbon emissions and utilizing energy-efficient production methods, Iranian companies can not only comply with international environmental standards but also appeal to eco-conscious buyers in foreign markets.

- Strategic Partnerships: Forming partnerships with foreign companies and investors can help Iran overcome some of the challenges posed by sanctions and economic barriers. Joint ventures with companies in regions like Africa or Southeast Asia could provide Iranian cement producers with access to new markets, technologies, and capital.

Conclusion

The cement industry in Iran is at a crossroads in 2024. While facing significant challenges such as declining exports and economic sanctions, the sector also has substantial opportunities for growth. Key markets like Pakistan, Kazakhstan, and India continue to demand Iranian cement, and companies like Azintrade are at the forefront of meeting this global demand.

Azintrade, with its extensive production capabilities and commitment to international standards, is a vital player in the global cement market. By offering a wide range of cement products for export, Azintrade is helping to solidify Iran's position as a major supplier in the global construction materials industry.

As infrastructure projects grow both domestically and abroad, and as new markets emerge, Iran’s cement industry is well-positioned to capitalize on these developments, ensuring its continued success in the years ahead.